The Shanghai exchange IPOs were primarily state owned enterprises. The Central government encouraged these IPOs in order to encourage these state owned enterprises to raise capital that could be used to reduce the government subsidies for those enterprises. This subsidy reduction for the central government released capital for other uses.

At the same time individual and institutional investors were encouraged to buy stocks through brokers. The market heated up and the market rose to more than 6,000 points at its highest. Investors felt the market could only go higher because they had never seen a market downturn. Brokers and analysts encouraged this wave of investing as well.

The majority of listed companies did not have transparent financials. There was not a system of objective stock analysts judging these companies so individual investors continued to buy.

Many investors sold their homes and other assets to invest in the market. many believe the bias toward gambling among many investors fed this wave of investing as well.

In late 2007 and early 2008 the market began to drop rapidly due to poor earnings and a general slow down in the economy. Individual investors began to loose huge amounts of capital. They did not have balanced portfolios but instead were fully invested in the stock market.

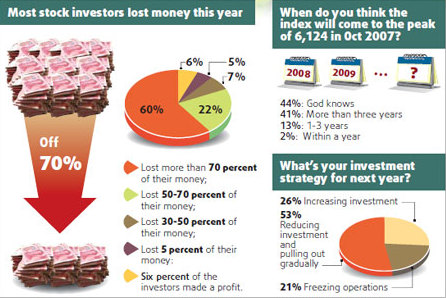

The net result is that the objectives of reducing subsidies was achieved on the back of indidual investors. The China Daily survey below demonstrates the impact of these losses.

The lesson from this calamity is that bubbles burst and when they burst everyone gets wet !

No comments:

Post a Comment